On this page

Subscribe for updates

Keep up with OrderEase and access industry-leading order operation insights.

If you’re using QuickBooks and are, or hope to start working with large retailers, you'll come to realize that QuickBooks doesn’t support EDI natively. Still, every large retail partner will expect you to be EDI compliant.

Without EDI integration software, suppliers end up with missed ASNs, SKU mismatches, and an order desk that's drowning in admin. Suppliers often describe this moment as the point where QuickBooks “starts to crack.”, and consider whether they need to migrate to a more robust ERP. What begins as a few manual workarounds quickly becomes a daily operational burden. Teams rekey the same purchase order between QuickBooks and retail portals. ASNs get created in a rush, often in a separate system. Invoices are uploaded manually. Spreadsheets multiply. And the moment order volume increases, the whole system starts to crack.

Sill, QuickBooks is not the problem and you likely don't need to upgrade to a new version or an entirely new ERP just to make EDI work for you.

This guide explains how QuickBooks EDI integration actually works and what modern suppliers are doing to stay compliant.

Why QuickBooks Isn’t EDI Compliant

EDI compliance means being able to send and receive documents (like purchase orders, invoices, and shipping notices) in the exact format and process required by your trading partners. But here’s the challenge: no version of QuickBooks (Online, Desktop, or Enterprise), includes native EDI capabilities.

QuickBooks is a highly rated accounting tool but it's not built to manage retailer-specific data rules, document translation, SKU mapping, or compliance checks. It doesn’t understand 850s, 810s, or 856s; it doesn’t know how to validate data for Home Depot versus Lowe’s; and it can’t prevent the chargebacks that follow from small errors.

Because QuickBooks can’t interpret EDI documents, your team becomes the “translator.”; without modern EDI integration, your team has to go into supplier portals, copy information into order forms, and then copy that data back into QuickBooks.

This is where the type of EDI solution you choose matters.

-

Legacy EDI systems provide connections to your retail buyers, but often operate as standalone tools. Because they don't connect to other channels, they end up requiring manual work and custom IT support.

-

Modern EDI platforms take a different approach. They sync to QuickBooks, automate EDI compliance, and unify EDI with every other order channel.

The Hidden Cost of Manual EDI for QuickBooks Users

Suppliers don’t realize how expensive manual EDI can be. When every single order moves through a retailer portal, QuickBooks, and shipping software, each manual step introduces a new opportunity for error.

A missed acknowledgment. A malformed shipment notice. A mismatched SKU. A mis-keyed price. All trigger penalties.

Your retail EDI partners will send chargebacks, often arrive weeks later, without a clean audit trail explaining where things went wrong. Over time, suppliers describe this as “QuickBooks getting in the way,” but the real culprit is the disconnect between QuickBooks and the EDI requirements placed upon it.

The Issue With Being Reliant on IT Teams for QuickBooks EDI

Most QuickBooks users aren't running multi-billion dollar enterprises. They're operating with lean teams that want to sell more without accruing technical debt. EDI, as old as it is, is still highly technical and requires specialized expertise. Most in-house teams won't know how to use tools like SPS Commerce or Cleo, and ultimately end up hiring third-party developers.

On top of the EDI platform fees, developers can add tens of thousands to your QuickBooks EDI project, especially as customizations increase.

Sales don't start and end with EDI. For successful businesses, an omnichannel strategy includes retail stores, online portals, and marketplace listings. Automating EDI with QuickBooks is only one piece of the puzzle. Adding all the order workflow logic for each channel snowballs into a massive investment for IT teams. When evaluating your options for QuickBooks EDI compliance, think beyond just EDI. Is a single piece of EDI software going to remove all the manual steps from your operations? Will the ROI be there?

The Benefits of QuickBooks EDI Integration

Connecting EDI (Electronic Data Interchange) with QuickBooks turns your trusted accounting system into a fully automated order hub. Instead of retyping retailer orders or manually matching invoices, EDI integration standardizes how documents move between your trading partners and QuickBooks.

Here’s the value of integrating QuickBooks and EDI:

1. Eliminate Manual Data Entry

Without EDI, every order is manually keyed into QuickBooks, which is a slow, error-prone process. EDI integration automates this completely. Orders flow directly into QuickBooks, and invoices are sent back automatically, removing human error and freeing up your team for higher-value work.

2. Improve Accuracy and Compliance

Retailers are strict about EDI accuracy and compliance. Something like an incorrect SKU or price mismatch can lead to chargebacks. Automated document exchange ensures every field is consistent with your retailer’s requirements.

3. Accelerate Order-to-Cash Cycles

Faster data flow means faster payments. With a QuickBooks EDI integration, invoices are generated and sent the moment an order ships, allowing customers to pay sooner and improving your cash flow.

4. Gain Full Visibility Across Orders and Channels

With an integrated solution, every transaction becomes part of your QuickBooks environment so finance and operations teams have a single source of truth.

5. Scale Without Adding Admin Overhead

As your business grows and adds more retail partners, manual EDI management doesn’t scale — but automated workflows do. EDI integration with QuickBooks lets you process higher volumes of orders without increasing headcount or risking errors.

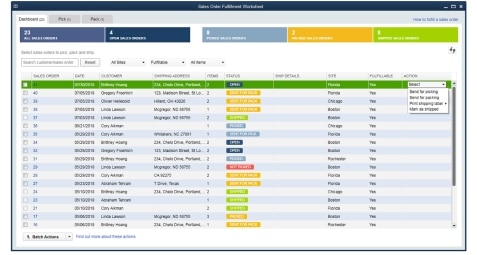

What QuickBooks EDI Integration Looks Like

A modern QuickBooks EDI integration removes every manual touchpoint you have when selling products through retail partners.

Here’s what that means in practice:

1. A retailer submits an 850 purchase order which is pushed directly into QuickBooks.

2. The system acknowledges the order and checks that the fields match the retailer’s requirements.

3. As the order moves through fulfillment, shipping data updates the order automatically.

4. The ASN is assembled the moment tracking information becomes available.

5. QuickBooks creates the invoice, and your integration transforms it into an 810.

The value of this isn’t just speed. It’s consistency and error-free EDI compliance. When everything is automated, ASNs don’t get missed, SKU mismatches disappear, and chargebacks don't impact your bottom line.

How to Be EDI Compliant with QuickBooks

Becoming EDI compliant with QuickBooks is about connecting to your retailers without all the portal jumping.

Here’s the process suppliers typically follow:

Understand QuickBooks’ EDI limitations

QuickBooks, whether Desktop or Online, doesn’t have built-in EDI features. That means purchase orders, invoices, and ASNs have to be filled out and sent by your team. To stay compliant, you’ll need an integration tool.

Identify your retailer’s EDI requirements

Every retailer has different EDI mandates. Document these requirements so you know exactly what your QuickBooks integration must handle. Keep track of these documents and clarify what vendors can handle when you book a call with them.

Choose an EDI integration solution

This is the critical step. Look for an EDI platform that:

-

Automates POs, invoices, and ASNs

-

Connects natively to QuickBooks

-

Handles EDI compliance for multiple retailers

Automate testing and validation

Before going live, test transactions with your trading partners. This ensures your QuickBooks integration is formatting documents correctly, avoiding chargebacks or rejections.

Go live and monitor compliance

Once testing is complete, launch your QuickBooks EDI connection. From here, monitor your transactions regularly to catch errors early, keep up with retailer changes, and stay compliant at scale.

QuickBooks and EDI

The Options Suppliers Consider for QuickBooks EDI

When suppliers search for “QuickBooks EDI,” “EDI for QuickBooks Online,” or “best EDI for QuickBooks,” they typically discover four categories of solutions:

1. Staying Manual

Managing EDI orders manually means teams are tied up processing individual orders, which increases the risk of order errors and keeps them in data entry roles. EDI workflows are more complex than typical B2B ordering, and the stakes are higher. Delayed shipments or outdated inventory updates damage relationships and lead to chargebacks from trading partners.

Take pricing, for example. QuickBooks typically supports one price per SKU, which works fine if all customers pay the same price. But in a wholesale or multichannel environment, pricing is rarely one-size-fits-all. As new partners come on board, each with different rates, things get messy quickly.

EDI trading partners often assign their own (unmatched) SKUs to your products. Without a way to map these to your internal SKUs, businesses often resort to less-than-optimal workarounds. The result? System bloat, fragile processes, and a QuickBooks setup that’s anything but streamlined.

QuickBooks can technically handle this level of complexity with manual workflows, but not efficiently, and not at scale.

Not sure if EDI software is worth the investment?

→ Try the EDI ROI calculator (Free, 30-second assessment)

2. Using EDI-Only Vendors

These systems specialize in retailer compliance; if you need to send 850s, 856s, or 810s back to a major retail partner, these platforms will get the job done.

→Note; you do not have to use the same EDI vendor your retail partner uses.

Here's the thing, EDI-only vendors only solve EDI. They don’t unify the rest of your order operations. The result is a workflow where EDI is automated, but everything else remains manual. You end up managing multiple portals, and re-entering data into QuickBooks because the EDI platform doesn’t talk to it natively. For suppliers trying to scale, this creates the exact bottlenecks they were trying to eliminate by adopting EDI in the first place.

3. Migrating to an ERP

ERP migration is incredibly risky; according to Gartner, 75% of all ERP change projects fail.

For many growing businesses, the smartest next move isn't to jump straight into a full ERP; it’s to stay on QuickBooks and add purpose-built EDI software to ensure compliance. Once EDI is automated, teams gain the bandwidth to shift their focus from fixing problems to building future-ready systems.

What your company really needs is a way to bridge the gap between its growing success and its order management capabilities, especially surrounding EDI. This is where integrations come in. They act as a way to expand the functionality of your QuickBooks package without having to completely upgrade it..

A good EDI integration allows your company to automatically handle EDI orders instead of manually inputting data. It should simplify every step of your order management process so you can focus on what really matters: growing your business and making sure that your products are getting out the door.

If you're ready to move off of QuickBooks, but want something familiar to your team, our top recommendations are Blue Link, Spire, and Sage. Each will offer more comprehensive order management solutions without an enterprise solution.

4. Using a Unified Order Management System

A unified order platform takes a fundamentally different approach from traditional QuickBooks EDI solutions. Instead of bolting on another standalone EDI tool, it centralizes every order to solve fragmented order operations. Rather than treating EDI as a separate workflow, a unified platform brings EDI, Shopify, marketplaces, B2B portal orders, rep-entered orders, and even email PDFs into one standardized system.

Suppliers who adopt this model aren’t just automating QuickBooks EDI; they’re rebuilding their order operations around a single source of truth. For growing companies that want to stay on QuickBooks but need modern EDI and order automation, a unified order platform removes the most friction.

Integrated EDI-QuickBooks Options

Choosing an EDI solution for QuickBooks isn’t just about achieving compliance; it’s about selecting the model that actually fits how your business operates. Most EDI tools were built to solely translate retailer documents and push them into QuickBooks. That works well if you only sell products through retailers, but it doesn't account for the operational challenges that come with managing multiple channels, pricing structures and workflows.

Before comparing providers, it helps to understand the two models in the market today:

-

Traditional EDI providers - EDI tools focused on exchanging retailer documents and ensuring compliance that operate as a standalone system

-

Managed-service EDI networks - EDI providers that fully handle mapping, testing, and updates for you, but often at higher cost and with limited flexibility.

-

Enterprise integration platforms (iPaaS) - Middleware that connects systems and moves data between them; powerful for IT teams, still require an EDI provider for compliance.

-

API-first EDI platforms - Modern, developer-oriented EDI connectivity services that provide clean APIs, but require engineering resources.

-

Modern order operations platforms - Systems that unify EDI and every other B2B order channel into one automated workflow.

Both approaches can be “EDI solutions,” but they solve fundamentally different problems.

OrderEase

Modern B2B EDI + Order Operations for QuickBooks (No IT Required)

What it is:

A unified B2B order operations platform that automates the full EDI lifecycle and consolidates every B2B sales channel (EDI, Shopify, marketplaces, B2B portal, reps) into a single workflow before syncing into QuickBooks.

Who it’s for:

Suppliers that want EDI automation and a scalable operational structure — not another silo.

How it works:

Automates 850 → 855 → 856 → 810, cleans data, standardizes pricing + SKUs, manages compliance, and pushes accurate sales docs into QuickBooks without middleware.

Pricing model:

Subscription-based. Low setup costs.

Best for:

Companies that want QuickBooks to remain their ERP while eliminating the operational chaos around it.

Top EDI integrations for QuickBooks include:

TrueCommerce

Traditional EDI Provider

What it is: Retailer-focused EDI platform with strong partner coverage.

Who it’s for: Suppliers mainly receiving EDI orders.

Pricing: High doc fees.

Strength: Broad retail network.

Limitation: EDI-only; multichannel workflows stay disconnected.

SPS Commerce

Fully Managed EDI Service

What it is: Outsourced EDI mapping, testing, and compliance.

Who it’s for: Teams that need to be integrated with a massive network of retailers

Pricing: Premium doc fees.

Strength: Large list of retail integrations .

Limitation: Costly; less control; not multichannel. Consisted reports of poor customer experience.

B2BGateway

Lightweight Cloud EDI

What it is: Cloud EDI solution popular with small/mid-size suppliers.

Who it’s for: Companies needing basic, reliable EDI.

Pricing: Moderate doc fees.

Strength: Simple onboarding.

Limitation: Limited automation; UI dated; not multichannel.

eZCom (Lingo)

Web-Based EDI

What it is: Portal-style EDI software with strong customer service.

Who it’s for: Small suppliers wanting user-friendly EDI.

Pricing: Moderate doc fees.

Strength: Good UI.

Limitation: Still requires manual workflows.

Orderful

API-First EDI Infrastructure

What it is: EDI connectivity for developers; not an operations tool.

Who it’s for: Companies with engineering teams who want custom EDI pipelines.

Pricing: Usage-based API pricing.

Strength: Fast partner onboarding; modern API.

Limitation: Requires developers; no order ops layer; no multichannel consolidation.

Pipe17

Automation Layer for DTC / Ops

What it is: API-based automation connecting ERPs, 3PLs, and ecommerce tools.

Who it’s for: DTC brands or hybrid sellers needing ecommerce routing.

Pricing: Subscription + order volume tiers.

Strength: Good for Shopify, Amazon, WMS connections.

Limitation: Not true EDI; no deep compliance tooling; not designed around QuickBooks for B2B; no SKU/pricing governance.

Celigo

iPaaS for SaaS Integrations

What it is: Integration middleware (flows between systems).

Who it’s for: Teams needing prebuilt connectors across SaaS tools.

Pricing: Subscription by flow/connection.

Strength: Great for ecommerce + ERP syncs.

Limitation: Still requires an actual EDI provider; adds complexity + cost.

Jitterbit

Integration & API Platform

What it is: Low-code integration builder.

Who it’s for: Mid-market teams with some IT resources.

Pricing: License-based.

Strength: Flexible.

Limitation: Not EDI; requires mapping work; needs IT to maintain.

Boomi

Enterprise Integration

What it is: Enterprise-grade iPaaS.

Who it’s for: Teams with engineering + multiple ERPs/systems.

Pricing: Tiered enterprise pricing + services. ($2,000–$5,000+/mo).

Strength: Strong for complex organizations.

Limitation: Overkill for 95% of QuickBooks companies; not EDI.

MuleSoft

Enterprise API + Integration Platform

What it is: The heavyweight iPaaS for global enterprises.

Who it’s for: Organizations with full IT teams + complex architectures.

Pricing: Very high enterprise licensing.

Strength: Robust data orchestration.

Limitation: Not EDI; requires developers; excessive for QuickBooks workflows.

ESTIMATED PRICING RANGES

(Market averages; varies by mappings, volume, and service bundles)

- Traditional EDI:

$300–$900/month + document fees - Managed-service EDI:

$600–$2,500/month + premium doc fees - API-first EDI:

$0.06–$0.50 per API call - iPaaS:

$800–$5,000+/month - OrderEase:

Flat subscription, no document fees, no IT costs

| Category | Best Fit | Effort to Maintain | Cost Predictability | Multichannel Support | Overall |

|---|---|---|---|---|---|

| OrderEase | QuickBooks users w/ EDI + multiple channels | Low | ⭐⭐⭐⭐ | Yes | ⭐⭐⭐⭐⭐ |

| TrueCommerce | Suppliers w/ heavy EDI | Medium | ⭐⭐ | No | ⭐⭐⭐⭐ |

| SPS Commerce | Fully outsourced | Med-High | ⭐ | No | ⭐ |

| B2BGateway | Small suppliers | Low | ⭐⭐⭐ | No | ⭐⭐⭐⭐ |

| Orderful | Dev teams | High | ⭐⭐⭐ | No | ⭐⭐⭐⭐ |

| Pipe17 | DTC brands | Low | ⭐⭐⭐⭐ | Partial | ⭐⭐⭐⭐ |

| Celigo / Boomi / MuleSoft | IT-heavy orgs | High | ⭐⭐ | No | ⭐⭐⭐⭐ |

Upgrading to QuickBooks Enterprise for EDI Compliance

If your business currently runs on a different tier of QuickBooks, upgrading to QuickBooks Enterprise will give you enhanced order management features. You’ll gain advanced pricing rules, better inventory tracking, and increased limits for SKUs and users. That can help untangle some of the workarounds, like having to duplicate SKUs just to assign custom pricing.

But here’s the catch: EDI-specific challenges don’t go away.

QuickBooks Enterprise still doesn’t support native EDI functionality. It won’t map your SKUs to your trading partners’ codes. It won’t automate document exchange. It won’t validate ASN formats or auto-acknowledge POs. And it definitely won’t protect you from chargebacks or fines tied to late responses or compliance errors.

So yes, upgrading can help streamline the way you handle pricing, inventory, and internal order processing—but when it comes to EDI compliance, manual entry, human oversight, and third-party plugins are still required. That means your order desk is still a bottleneck, and scaling up still means scaling manual effort.

Eventually, the question becomes not “should you upgrade QuickBooks?”—but “how long can you afford to patch EDI around it?”

Connect & Automate EDI IntegrationFlows with Top Trading Partners |

Choosing the Right QuickBooks EDI Integration Partner

Nearly every EDI provider can translate documents, but very few act as the foundation for operational growth.

A strong QuickBooks EDI solution should:

-

Centralize order management in a single platform—no more bouncing between portals

-

Eliminate manual data entry across EDI workflows

-

Support bidirectional data exchange (both sending and receiving EDI documents)

-

Integrate seamlessly with logistics and fulfillment tools to automate downstream processes

Of these, bidirectional data exchange is the most important. Some EDI solutions only pull data in—orders arrive, but your team is still responsible for manually updating other systems or submitting outbound documents. In that case, you’ve only solved half the problem.

True automation means being able to both push and pull data between QuickBooks and your trading partners. When your system can automatically send order updates, confirmations, shipment notices, and invoices, the entire process becomes hands-off, and your business stays in full compliance without the overhead.

That level of automation doesn’t just save time. It reduces human error, prevents compliance failures, and removes the need for your team to babysit every order.

How OrderEase Helps QuickBooks Users Automate EDI (Without Rebuilding Systems)

At the end of the day, businesses don’t need to rip out systems that are already working. What they need is targeted functionality that manages complex EDI workflows. A well-built integration should enhance what you’re already doing, not force you into a full system replacement before you're ready.

That’s the value of purpose-built EDI integration for QuickBooks. It delivers the automation and compliance you need, while keeping your core financial system intact and familiar to your team.

That’s the value of purpose-built EDI integration for QuickBooks. It delivers the automation and compliance you need, while keeping your core financial system intact and familiar to your team.

OrderEase is a system of action that standardizes every B2B order type before the data reaches QuickBooks. EDI becomes just one part of a broader, unified operational workflow.

Frequently Asked Questions about QuickBooks and EDI

Is QuickBooks EDI compliant?

No. QuickBooks Online, Desktop, and Enterprise all require a third-party solution for EDI.

What’s the risk of handling EDI manually with QuickBooks?

Manual processing leads to errors, late ASNs, and chargebacks, all of which add up and eat away at margins.

What’s the difference between QuickBooks Desktop and QuickBooks Online for EDI?

Both versions require integration, but the connection methods differ:

-

QuickBooks Desktop often requires local connectors.

-

QuickBooks Online connects via cloud APIs.

How does OrderEase make QuickBooks EDI compliant?

OrderEase acts as your EDI “translator.” We automatically process POs, invoices, and ASNs from your retailers, format them for compliance, and sync them into QuickBooks. Everything flows automatically.

Is QuickBooks EDI only for large companies?

Not at all. In fact, mid-sized suppliers using QuickBooks are often the ones most burdened by manual EDI. Automation helps them scale without hiring extra staff.

What are the best EDI software options compatible with QuickBooks?

How does EDI integration improve QuickBooks workflows?

EDI integration automates how orders, invoices, and payments flow between QuickBooks and your trading partners. Instead of downloading files or retyping data from retailer portals, EDI integration sends order documents directly into QuickBooks in a structured format. With solutions like OrderEase, EDI integration goes even further. OrderEase standardizes every order whether it comes from a retailer portal, marketplace, or sales rep, and automatically syncs that data into QuickBooks.

Can I connect QuickBooks with EDI systems like TrueCommerce or SPS Commerce?

Yes, QuickBooks can connect with EDI providers like TrueCommerce or SPS Commerce. They’re a solid option if your business only needs to handle traditional retailer EDI transactions. However, TrueCommerce and SPS Commerce are built specifically for EDI, not for managing other digital sales channels. That means you’ll still face manual workflows to import, format, or reconcile orders coming from eCommerce sites, reps, or direct customers.

With OrderEase, you get a more unified approach. It connects QuickBooks not just to EDI systems, but to all your B2B and online sales channels. This eliminates the patchwork of integrations and manual data handling that often comes with traditional EDI-only tools.

QuickBooks EDI

Automatically capture EDI orders from retail partners and sync them directly into QuickBooks. No complex setup, no middleware, no stress.

Sync every EDI order

Discover the Order Management System built to unify your entire order operations workflow. With OrderEase, you can standardize data, automate downstream tasks, and keep your accounting system perfectly in sync without relying on middleware or spreadsheets.

.png?height=290&name=QuickBooks%20EDI%20automation%20(2).png)

.png?width=900&height=450&name=QuickBooks%20EDI%20Software%20(1).png)